Of late, financial institutions have started using blockchain networks to tokenize real world assets. This has generated a lot of excitement in the world of finance. Tokenization allows banks to create markets with the benefits of decentralized finance (DeFi), secure real-world assets on the blockchain, and increase the efficiency of transactions via smart contracts.

Someone might tokenize a real-world asset, such as property or artwork, to convert it into a digital asset that can be easily traded, bought, or sold online, without the need for traditional paperwork-based processes and intermediaries. This adds speed to financial markets, as the value of physical things can be traded more quickly. It can also allow new people to invest in certain assets, as a digital asset can be divided, or fractionalized, making it more accessible to a broader audience.

Why Tokenize Assets?

The benefits of asset tokenization include increased liquidity and the removal of intermediates such as brokers. Tokenization can also reduce transaction costs, increase transparency, and allow for greater flexibility in ownership structures.

Increasingly, with partners like Kaleido, financial institutions that want to start tokenizing assets no longer need expertise in blockchain technology to build a digital asset strategy. They simply need to ensure that the underlying assets are accurately represented and that there are safeguards in place to prevent fraud and ensure compliance with regulatory requirements.

Efficiency

- Tokenization eliminates many of the intermediaries and administrative costs associated with traditional asset transactions, potentially reducing transaction costs and increasing efficiency.

Liquidity

- Tokenization allows assets to be easily traded on digital marketplaces, enabling investors to buy and sell assets with greater ease and efficiency. This can increase liquidity in the market, which can attract more investors and potentially increase asset values.

Transparency

- Tokenization creates a transparent and immutable record of ownership and transaction history, making it easier to track the ownership and value of assets. This can improve trust and reduce fraud in the market.

Accessibility

- Tokenization offers investors the opportunity to invest in resources that were previously inaccessible or hard to access due to geographic, legal, or other restrictions. Fractionalization makes unique assets available to larger populations of people.

Importantly, tokens can streamline international business as they facilitate cross-border transactions. By providing greater visibility into the real-time location and value of an asset we can gain insights into the value of a portfolio or transactions within a portfolio. This makes assets in motion more trackable and leaves us an audit trail as we conduct business internationally.

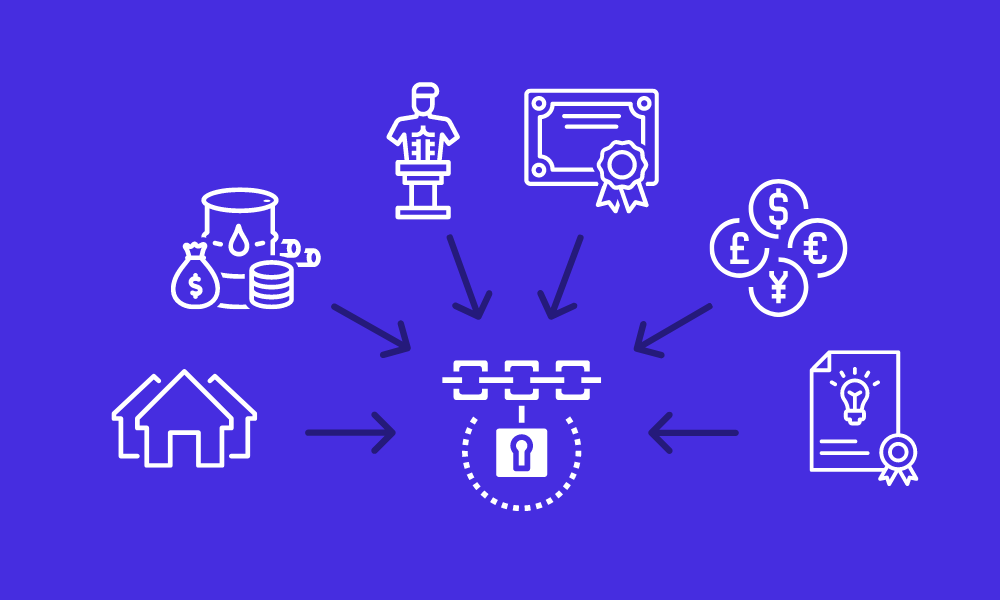

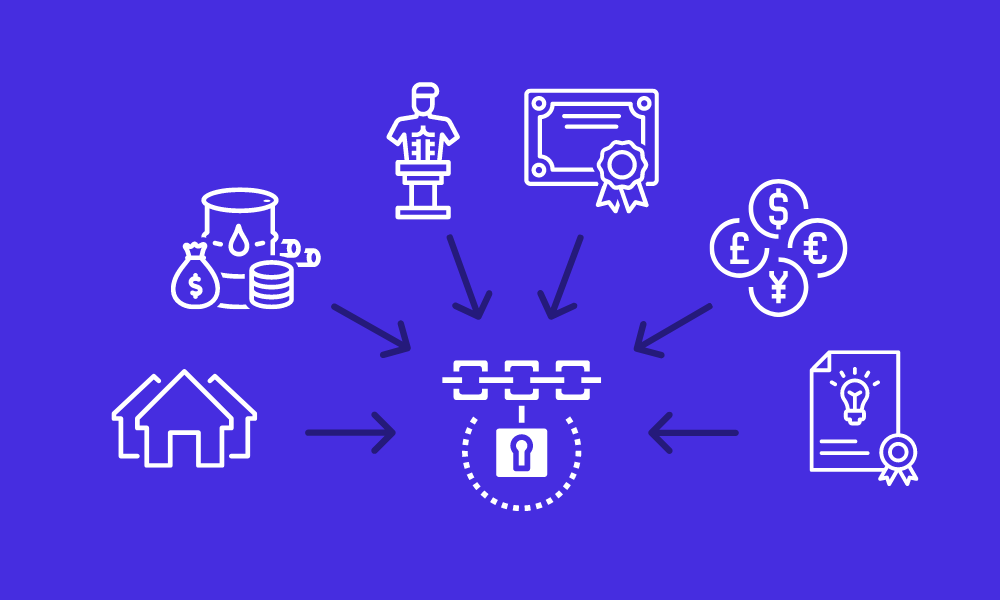

What Assets Can Be Tokenized?

Tokenization of real-world assets is a major growth opportunity for financial institutions, both traditional banks and those who start in the decentralized space.

Let’s look at some industries and use cases for tokenizing real-world things.

Commodities

Banks use tokenization to represent and trade commodities on the blockchain by creating digital tokens that represent ownership of the underlying commodity. These tokens can be traded on a blockchain-based platform, allowing for faster and more secure transactions.

The tokens are typically backed by physical commodities held in storage, and can be redeemed for the underlying asset if desired. This allows banks to streamline commodity trading, reduce transaction costs, and provide greater transparency to investors.

Stocks and Securities

Banks use tokenization to represent and trade stocks and securities on the blockchain by creating digital tokens that represent ownership of the underlying assets. The tokens are typically backed by securities held in custody, and can be redeemed for the underlying asset if desired. This allows banks to streamline securities trading, reduce transaction costs, and provide greater transparency to investors.

Fractional ownership in stocks and private equity is an interesting concept too, as it allows new communities to pool resources to make purchases. Banks can use tokens to improve liquidity, as we can use current assets for collateral against future purchases.

Currencies

Financial institutions use tokens to represent real currency holdings by creating digital tokens that are backed by physical currency held in reserve. These tokens are called "stablecoins" and are designed to maintain a stable value relative to the currency they represent, such as the US dollar. Kaleido has a lot of experience building institutional grade financial platforms.

The amount of currency held in reserve is audited and verified by third-party organizations to ensure that there is a one-to-one backing of the stablecoin with the underlying currency. This allows faster and more secure transactions for fiat currency transactions, as well as providing a bridge between the traditional financial system and the world of cryptocurrencies.

Intellectual Property

Tokens can represent intellectual property, including ownership or licensing rights to a particular piece of intellectual property, such as a patent or copyright. These tokens can be traded on a blockchain-based platform, allowing for greater transparency and efficiency in the licensing and distribution of intellectual property.

The tokens can also be programmed with smart contract functionality to automate royalty payments, licensing terms, and other contractual obligations. This allows financial institutions to streamline the management of intellectual property, reduce transaction costs, and provide greater liquidity for intellectual property owners.

Real Estate

Banks can tokenize a real estate asset to increase their liquidity, as a digital asset is easier to buy, sell, or fractionalize. Investors can buy smaller portions of the property, which can reduce the barriers to entry, making it more accessible to a broader range of investors. This means banks can access new customers, including those who might not be able to afford a whole property or don't want to take on the risk of owning an entire property.

Tokenization of real estate assets can eliminate intermediaries, reducing the time and cost involved in completing transactions. These transactions can then be made transparent or audited.

Cost is another benefit as we digitize physical places. We can reduce the costs associated with managing assets, such as property maintenance, insurance, and legal fees.

Art and Collectibles

Tokenization of a piece of art involves creating a digital representation of the artwork on a blockchain network. This digital representation can be bought, sold, or traded like a cryptocurrency. This increases liquidity, as the token can be used for collateral against a loan. We can also imagine all the new people who could own a great piece of art if, say, they owned one millionth of a Picasso.

With the price of art skyrocketing in some markets, this technology can create a tamper-proof record of ownership and transaction history, reduce fraud, stop counterfeits, and prove provenance.

Token Standards for Financial Institutions

Financial institutions use different token standards to tokenize real-world assets, depending on the specific use case and platform they are using. Some of the most commonly used token standards for asset tokenization are:

- ERC-20: The ERC-20 is the most widely used standard for tokenizing assets on the Ethereum blockchain. It defines a set of rules and functions for creating and managing fungible tokens, which are identical and interchangeable with each other. This standard is commonly used for tokenizing digital assets such as securities, commodities, and real estate.

- ERC-721: The ERC-721 token standard is used for creating non-fungible tokens (NFTs), which represent unique assets that cannot be replicated. This standard is commonly used for tokenizing collectibles, art, and other unique assets.

- ERC-1155: The ERC-1155 token standard is a newer standard that allows for the creation of both fungible and non-fungible tokens on the same smart contract. This standard is used for tokenizing gaming items, virtual real estate, and other assets that have both fungible and non-fungible characteristics.

- ERC-1400: The ERC1400 is a token standard for security tokens. It provides a set of rules for token issuance, transfer, and redemption, enabling compliance with relevant regulations and facilitating security token offerings.

- ERC-1404: ERC1404 is a token standard for security tokens that focuses on compliance with legal and regulatory requirements. It provides a set of rules to limit token transfers based on specific criteria, such as investor accreditation, ensuring regulatory compliance in security token offerings.

- ERC-1410: ERC1410 is for security tokens that provides a modular framework for token issuance, management, and trading, allowing issuers to customize token features and investor rights. It supports functionalities like partial transfers, token lock-ups, and token voting.

- ERC-1462: ERC1462 is a token standard for digital securities on the Ethereum blockchain. It allows for the representation of real-world assets like equities, bonds, and funds as tokens. It enables compliance with relevant regulations and facilitates the trading of digital securities on a decentralized platform.

How Do Businesses Make Money From Tokenization?

Asset tokenization refers to the process of converting rights to an asset into a digital token on a blockchain, as we've outlined above. Enterprises can monetize these tokenized assets by creating new revenue streams.

- Fractional ownership allows businesses to offer smaller portions of high-value assets, making them accessible to a broader investor base, thereby generating revenue through token sales or trading fees.

- By facilitating liquidity enterprises can enable investors to buy, sell, and trade these tokens easily, charging transaction fees or commissions.

- Enterprises can create value-added services around tokenized assets, such as asset management, smart contract development, or compliance solutions, offering these services for a fee.

- Finally, by utilizing blockchain technology, enterprises can streamline processes, reduce intermediaries, and lower operational costs, thus enhancing profitability.

Overall, asset tokenization provides enterprises with opportunities to unlock liquidity, broaden investor participation, and create new revenue streams in a digitally transformed financial landscape.

We've written more about the tokenization process and challenges of tokenization to help you weigh the pros and cons of starting a tokenization project.

Common Questions Businesses Have About Asset Tokenization

How do regulatory frameworks impact the adoption of tokenization in different jurisdictions?

The impact of regulatory frameworks on tokenization adoption varies significantly across jurisdictions. Regulatory clarity is essential for enterprises to navigate legal complexities and ensure compliance.

In many regions, the legal status of digital tokens and the requirements for their issuance, trading, and taxation are evolving.

Enterprises must stay informed about relevant regulations and possibly engage with legal experts to navigate this landscape.

Some jurisdictions have started to establish clearer guidelines for digital assets, which can facilitate tokenization efforts. However, the lack of harmonized regulations globally poses a challenge for multinational enterprises, requiring a tailored approach in each jurisdiction to mitigate legal and compliance risks.

What are the key technological challenges and solutions in implementing tokenization for enterprise-level assets?

Implementing tokenization presents the need for secure and scalable blockchain infrastructure, integration with existing financial and IT systems, and managing digital identities and privacy.

Enterprises must choose the right blockchain platform that aligns with their security, scalability, and interoperability requirements.

Solutions may include private or consortium blockchains for controlled access and better performance, using established blockchain protocols that support smart contracts for automating transactions, and implementing robust identity management systems to ensure privacy and compliance with regulations like GDPR.

Partnerships with blockchain technology providers like Kaleido can also offer specialized expertise and infrastructure tailored to enterprise needs.

How can enterprises measure the ROI of implementing tokenization for their assets?

Measuring the ROI of tokenization projects involves evaluating both tangible and intangible benefits.

Tangibly, enterprises can assess cost savings from reduced transaction times and costs, increased efficiency in asset management, and the ability to unlock liquidity in previously illiquid assets through fractional ownership.

Intangibly, tokenization can enhance market reach and customer engagement by offering innovative investment products and services.

Quantifying these benefits requires setting clear metrics before implementation, such as transaction cost reduction, speed of asset transfer, and market size expansion.

Additionally, enterprises should consider the competitive advantage gained from early adoption of tokenization technologies, which can position them as leaders in their respective industries.